News/Current Events, discussion (Bullets, Ballots & Bombs)

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

- richard rorty, achieving our country. 1998.

Shaun King has supposedly been flooded with 10k reports of hate "crimes"-- or hateful behavior or however it should be designated-- over the past two days. Here's a refined list of 200

https://www.splcenter.org/hatewatch/201 ... ection-day

Note: I have no idea about the reliability of any of this. Of course it won't compare to the oppression white males have increasingly faced in the US over the past two decades

If Trump repeals Dodd Frank the banks will have free reign. The pharma/biotech stocks also breathed a deep collective sigh of relief as Clinton's crosshairs were withdrawn. So we will be careening toward the next eventual "correction" (read: market crash) pumped full of sedatives and purple pills for the maladie du jour.

- 5

-

qalandar - Posts: 94

- Joined: Mon Sep 08, 2014 8:49 am

- Reputation: 1140

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

admiration of the rich but resentment of the professional class. an interesting take on what happened last week.

can't believe steve bannon is chief strategist. i posted this here earlier in the year but maybe worth doing again.

what john mccain and john kasich adviser thinks about it

- 3

-

rublev - Political Editor

- Posts: 989

- Joined: Tue Dec 31, 2013 7:57 pm

- Reputation: 4234

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

ADL just released a statement condemning appointment of bannon

in other news

battle of britain touting 5 star shit talker farage decided to spend remembrance sunday in trump tower

in other news

battle of britain touting 5 star shit talker farage decided to spend remembrance sunday in trump tower

- 3

-

rublev - Political Editor

- Posts: 989

- Joined: Tue Dec 31, 2013 7:57 pm

- Reputation: 4234

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

^ loathsome though all these types are it's exasperating that the left-wing info bubble is still in full effect. the guardian spent yesterday front-paging the rout in US bonds (same vein as the 'sterling drops of a cliff' post-brexit headline)- but doesn't a sell-off in long-dated treasuries mean the markets are predicting economic growth- ie presumably what tens of millions of people voted for?

which raises the point that if the infrastructure spend goes ahead as planned it could, at least in theory, be the type of applied keynesian stimulus that opponents of neo-liberalism have been advocating since the GFC (as opposed to the ongoing austerity/QE package that would almost certainly have been the Hilary way)

which raises the point that if the infrastructure spend goes ahead as planned it could, at least in theory, be the type of applied keynesian stimulus that opponents of neo-liberalism have been advocating since the GFC (as opposed to the ongoing austerity/QE package that would almost certainly have been the Hilary way)

- 3

Last edited by pirxthepilot on Tue Nov 15, 2016 2:36 pm, edited 2 times in total.

-

pirxthepilot - Posts: 507

- Joined: Wed Jul 23, 2014 7:26 am

- Reputation: 2022

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

What's the solution to the left wing info bubble? Other than doubting everything I read?

- 4

-

bels - Yung Winona

- Posts: 5087

- Joined: Thu Jul 11, 2013 2:43 pm

- Reputation: 18872

-

pirxthepilot - Posts: 507

- Joined: Wed Jul 23, 2014 7:26 am

- Reputation: 2022

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

plenty lead with the bond issue - so did WSJ (not really part of the left wing info bubble). worst week in more than 7 years for US treasuries is significant. inflation is obviously a worry. if you think about what trump actually said on the campaign - slashing taxes, what seems to be extraordinary high levels of spending etc, combined with protectionist trade and 'send them home' immigration - kinda sounds right for high inflation. we'll likely see instability until it's clear whether any of that becomes reality (via congress). not surprised it's being called out.

re the infrastructure spending - we don't really know what it will entail. seems to be a bipartisan issue with lots of democrats already saying they'd work with trump on the issue. but i'm not surprised trump likes the idea (it's almost another way for him to stick his name on things). if you look at the contract he released it says "Leverages public-private partnerships, and private investments through tax incentives, to spur $1 trillion in infrastructure investment over ten years. It is revenue neutral.". peter navarro is the economist shaping much of trump's economic thinking. if you read what he's much of it reads like a certain type of privatisation playbook. problem with this is that infrastructure built will in many cases be profit motivated - fine for a big projects in NYC or LA etc, but what about the smaller cities where the work really needs to be done (and there is less business interest)? you give investors a bigger cut of the profits. or people take risks, cut corners to reduce costs (, ). the irony is that trump got rich by licensing his name to projects - he'd be doing the same with the government. it's about big money and decisions happening elsewhere - not local communities.

also, the idea that infrastructure is apolitical / 'good' doesn't wash. we've seen what trump thinks about climate change so could well expect to see more keystone pipelines, refineries etc, while curbing investment in renewables.

re the infrastructure spending - we don't really know what it will entail. seems to be a bipartisan issue with lots of democrats already saying they'd work with trump on the issue. but i'm not surprised trump likes the idea (it's almost another way for him to stick his name on things). if you look at the contract he released it says "Leverages public-private partnerships, and private investments through tax incentives, to spur $1 trillion in infrastructure investment over ten years. It is revenue neutral.". peter navarro is the economist shaping much of trump's economic thinking. if you read what he's much of it reads like a certain type of privatisation playbook. problem with this is that infrastructure built will in many cases be profit motivated - fine for a big projects in NYC or LA etc, but what about the smaller cities where the work really needs to be done (and there is less business interest)? you give investors a bigger cut of the profits. or people take risks, cut corners to reduce costs (, ). the irony is that trump got rich by licensing his name to projects - he'd be doing the same with the government. it's about big money and decisions happening elsewhere - not local communities.

also, the idea that infrastructure is apolitical / 'good' doesn't wash. we've seen what trump thinks about climate change so could well expect to see more keystone pipelines, refineries etc, while curbing investment in renewables.

- 5

-

rublev - Political Editor

- Posts: 989

- Joined: Tue Dec 31, 2013 7:57 pm

- Reputation: 4234

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

i can see why the WSJ would lead with it- for their readers, inflation is a huge worry as it will erode the value of their assets.

i know very little about economics but from a labour market perspective at least isn't inflation a good thing? (implies rising wages, increased demand/confidence, more people in the workforce). plus, the big problem over the last few years has been getting inflation up to the 2% target, despite lowest interest rates in living memory. and even then, with a hawkish fed (likely to be even more so), if it were to rise rapidly higher rates could come into play.

hadn't read that infrastructure document but it does make for grim reading.

i know very little about economics but from a labour market perspective at least isn't inflation a good thing? (implies rising wages, increased demand/confidence, more people in the workforce). plus, the big problem over the last few years has been getting inflation up to the 2% target, despite lowest interest rates in living memory. and even then, with a hawkish fed (likely to be even more so), if it were to rise rapidly higher rates could come into play.

hadn't read that infrastructure document but it does make for grim reading.

- 3

Last edited by pirxthepilot on Wed Nov 16, 2016 10:40 am, edited 4 times in total.

-

pirxthepilot - Posts: 507

- Joined: Wed Jul 23, 2014 7:26 am

- Reputation: 2022

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

The infrastructure will get fixed no matter what, even if it comes down to letting a few bridges collapse and innocents suffer. Most of the bridges were built 50+ years ago with an expected lifespan of 50 years. There will be short term spending, but no way in hell can Trump cut taxes, regulate trade, and also make the budget work.

America's infrastructure report card, this was from 3 years ago:

http://www.infrastructurereportcard.org/grades/

America's infrastructure report card, this was from 3 years ago:

http://www.infrastructurereportcard.org/grades/

- 2

-

Copeland - Posts: 262

- Joined: Sun Jan 18, 2015 9:40 pm

- Reputation: 794

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

I don't really think that "reading both sides" is a valid media strategy when both sides are reporting bunkum. That just leaves you in the position of trying to pick which bunkum to support, using bunkum facts.

- 3

-

bels - Yung Winona

- Posts: 5087

- Joined: Thu Jul 11, 2013 2:43 pm

- Reputation: 18872

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

http://www.mtv.com/news/2955021/shirtle ... ng-kitten/

Reminds me of that short story by Vladislav Surkov

http://www.bewilderingstories.com/issue ... t_sky.html

Think this is something adam curtis is deeply mining lately with his hyper normalisation thing that I haven't seen.

Reminds me of that short story by Vladislav Surkov

http://www.bewilderingstories.com/issue ... t_sky.html

Think this is something adam curtis is deeply mining lately with his hyper normalisation thing that I haven't seen.

- 1

-

bels - Yung Winona

- Posts: 5087

- Joined: Thu Jul 11, 2013 2:43 pm

- Reputation: 18872

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

video earlier this week of an anti trump rally in LA got 30K retweets even though it was from caracas in september

oxford dictionaries word of the year has been announced as 'post-truth' (...or has it?)

- 5

-

rublev - Political Editor

- Posts: 989

- Joined: Tue Dec 31, 2013 7:57 pm

- Reputation: 4234

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

- 4

Last edited by sknss on Wed Nov 16, 2016 1:50 pm, edited 1 time in total.

Reason: broken link

Reason: broken link

-

rublev - Political Editor

- Posts: 989

- Joined: Tue Dec 31, 2013 7:57 pm

- Reputation: 4234

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

^im sure youre right but this is what i'm struggling to get to grips with. post GFC i read a lot about the obsession with inflation/fiscal deficits being no more than a neo-liberal dogma, one that could only lead to low growth, unemployment, stagnant wages, slack consumer demand etc. which is pretty much what we've had, and which I think has been the single biggest contributing factor to the brexit/trump phenomena. so from that perspective the idea of saying forget inflation, we need to focus on full employment (which is what governments did pre-1970(?)s might actually have some merit? as rublev says, the actual implementation will doubtless be awful if it happens at all. but maybe, in outline at least, this is the kind of bold stimulus obama should've undertaken instead of QE - which by feeding into asset prices rather than wages only made the rich richer and didn't help workers at all

- 2

Last edited by pirxthepilot on Thu Nov 17, 2016 6:52 am, edited 2 times in total.

-

pirxthepilot - Posts: 507

- Joined: Wed Jul 23, 2014 7:26 am

- Reputation: 2022

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

*looks down nervously*

- 1

"Authorities say the phony Pope can be recognized by his high-top sneakers and incredibly foul mouth."

-

starfox64 - Posts: 1147

- Joined: Wed Jul 24, 2013 4:41 am

- Location: your mom

- Reputation: 2134

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

- 0

“clothing for attractive rich people in their 20s to go to weddings in” — Zack Johnson on Vineyard Vines

-

adiabatic - Posts: 301

- Joined: Tue Mar 31, 2015 12:10 pm

- Reputation: 374

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

thinking more about curtis and the above, and kind of merging into the 'art thread'... ("isn't all art political?" *sips decafe latte*) metahaven are a design studio based in amsterdam. you can read about them , , and . for me they're one of the most exciting / weird / intelligent things happening in the 'design field' (as broad as that might be). anyway one of their recent projects was a film looking at propaganda and the internet as “a weapon of mass disruption”. the website for the project is . peter pomerantsev pops up in it, who is great.

some clips

- 5

-

rublev - Political Editor

- Posts: 989

- Joined: Tue Dec 31, 2013 7:57 pm

- Reputation: 4234

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

whoa that was pretty cool. can we get some kind of discussion group on this (separate from this thread)? i need some grad student guidance in this piece.

- 2

-

teck - Posts: 537

- Joined: Thu Aug 01, 2013 10:17 am

- Reputation: 1812

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

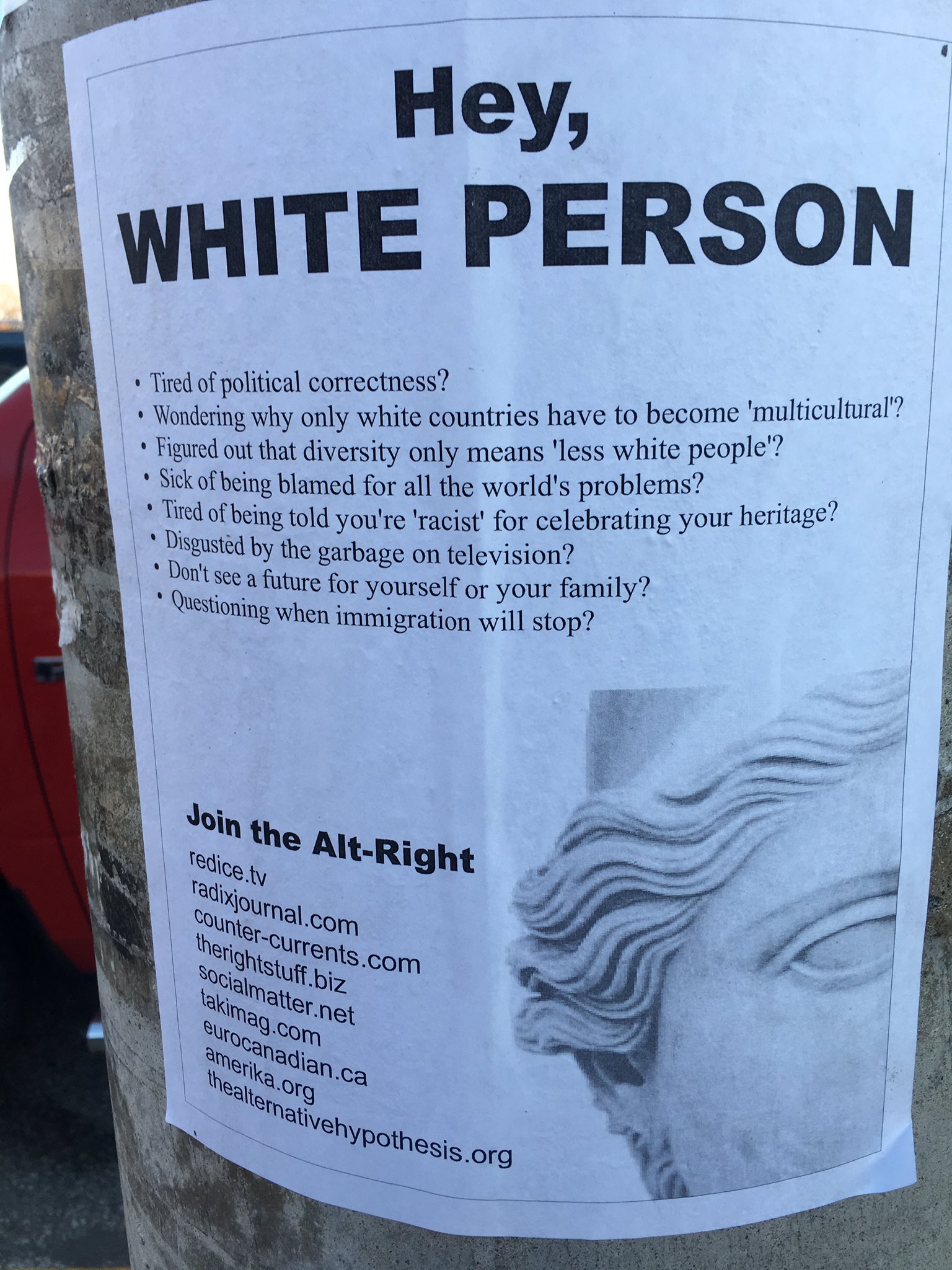

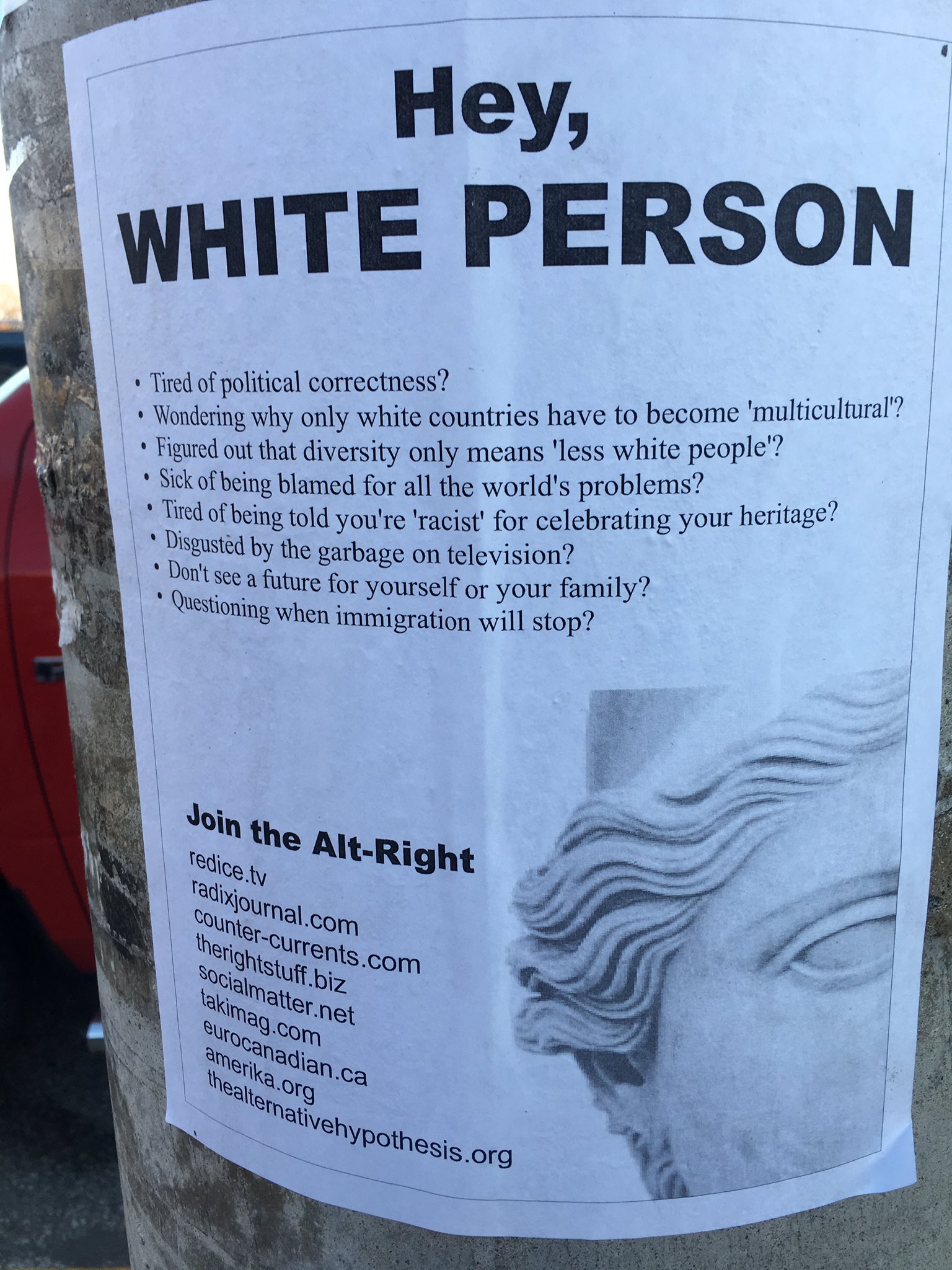

we got these signs in fake canada:

quickly followed by these signs:

quickly followed by these signs:

- 6

-

mc-lunar - Posts: 585

- Joined: Sat Jan 04, 2014 12:27 am

- Reputation: 3537

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

- 0

“clothing for attractive rich people in their 20s to go to weddings in” — Zack Johnson on Vineyard Vines

-

adiabatic - Posts: 301

- Joined: Tue Mar 31, 2015 12:10 pm

- Reputation: 374

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

It was stupid of Hillary to expect that the Latinos would vote as one bloc, that they would automatically be turned off Trump's comments.

- 1

-

Copeland - Posts: 262

- Joined: Sun Jan 18, 2015 9:40 pm

- Reputation: 794

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

http://www.motherjones.com/politics/201 ... trump-wall

the wall already exists pretty much, democrats built it

the wall already exists pretty much, democrats built it

- 0

-

pirxthepilot - Posts: 507

- Joined: Wed Jul 23, 2014 7:26 am

- Reputation: 2022

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

- 3

"Authorities say the phony Pope can be recognized by his high-top sneakers and incredibly foul mouth."

-

starfox64 - Posts: 1147

- Joined: Wed Jul 24, 2013 4:41 am

- Location: your mom

- Reputation: 2134

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

- 1

“clothing for attractive rich people in their 20s to go to weddings in” — Zack Johnson on Vineyard Vines

-

adiabatic - Posts: 301

- Joined: Tue Mar 31, 2015 12:10 pm

- Reputation: 374

Re: News/Current Events, discussion (Bullets, Ballots & Bomb

as little as i think this will matter, shouldn't the recounts be automatic?

i realize that there are some that are automatic if the decision is too close but still

i realize that there are some that are automatic if the decision is too close but still

- 1

Last edited by starfox64 on Thu Nov 24, 2016 11:23 am, edited 1 time in total.

"Authorities say the phony Pope can be recognized by his high-top sneakers and incredibly foul mouth."

-

starfox64 - Posts: 1147

- Joined: Wed Jul 24, 2013 4:41 am

- Location: your mom

- Reputation: 2134

Who is online

Users browsing this forum: No registered users and 14 guests